Market Rental Analysis and Determination are integral in renting, selling or buying industrial property.

Market rental analysis is the estimating of the fair market value of a property based on the rents and terms of comparable properties in the same market. It is an essential tool for investors, developers, landlords, tenants and appraisers who need to assess the profitability and viability of industrial real estate projects.

Industrial real estate refers to properties used for manufacturing, warehousing, distribution, logistics or other industrial purposes. Industrial properties vary in size, location, design, functionality and quality and therefore require a specialised approach to market rental analysis.

The main steps of market rental analysis for industrial real estate are:

- Define the subject property and its characteristics, such as location, size, age, condition, layout, amenities, zoning and environmental factors.

- Identify the relevant market area and submarkets where the subject property competes for tenants and buyers. The market area should reflect the geographic boundaries and economic drivers that influence the demand and supply of industrial properties.

- Collect data on comparable properties with similar characteristics in the same market area as the subject property. The data should include information on rents, lease terms, vacancy rates, incentives, operating expenses and sales prices.

- Adjust the data on comparable properties to account for differences in physical, functional and economic attributes that affect their value relative to the subject property. The adjustments should be based on sound reasoning and market evidence.

- Analyze the adjusted data on comparable properties to derive a range of market rents and capitalisation rates for the subject property. The analysis should consider market trends, supply and demand conditions, tenant preferences and risk profiles.

- Apply the market rents and capitalisation rates to the subject property to estimate its fair market value and income potential. The estimate should be supported by a clear and concise report explaining the market rental analysis’s methodology, assumptions and conclusions.

Market rental analysis is a complex and dynamic process that requires a thorough understanding of the industrial real estate sector and its nuances. By conducting a proper market rental analysis, one can make informed decisions and optimise the performance of industrial real estate investments.

As industrial property specialists in Cape Town, we can accurately advise on market rentals. We ensure the best possible options for your unique requirements. Assisting landlords and tenants with market rental analysis, leasing contracts and lease renewals.

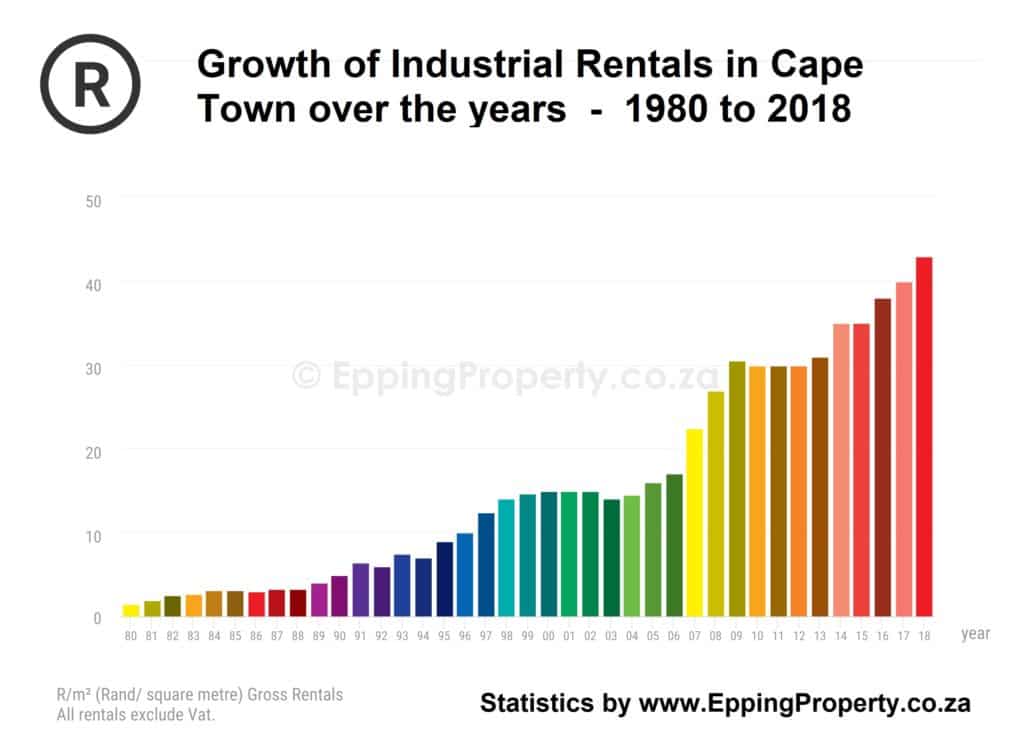

We have a handle on market rentals for many years:

How Epping Property can assist with your Market Rental Analysis

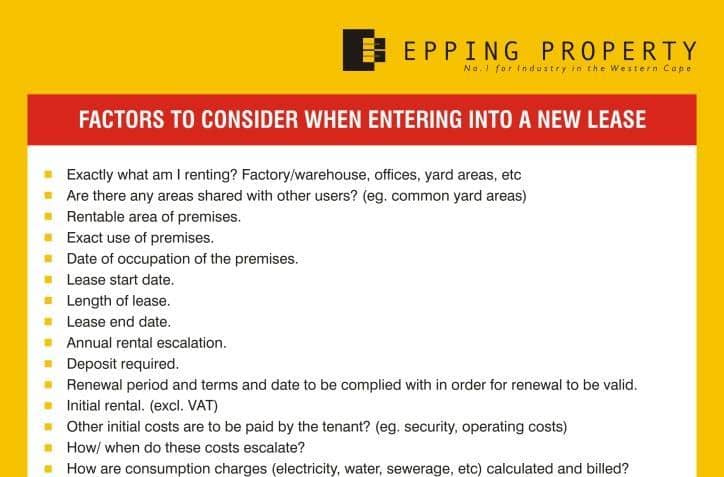

At Epping Industrial Property, we work with daily transactions between clients on both sides of the rental fence. Whether tenant or landlord, armed with our wealth of relevant knowledge and expertise, we can significantly assist in determining what fair market rentals are. Furthermore, we undertake a detailed analysis of rentals applicable to particular premises. This allows us to give clients a full image of the space, including the potential opportunities for the specific property.

A comprehensive market rental analysis often ends up being to the benefit of all parties. It shows landlords how to maximise their property usage and demonstrates to tenants where a particular property lies within the market. As well as how the cost compares. One gets a far better understanding of the rental’s components. Also, why the desired property is worth the required amount?

Market Rental Analysis and Determination

Our existing clients include some giant corporations in South Africa and some multinational companies. A testament to the understanding and expertise of our team. With a comprehensive understanding of our market, we can facilitate some transactions that streamline your dealings with a property. With our client’s success in mind, our team strives to find tenants and landlords the perfect coupling to further grow their businesses or portfolios.

Epping Property has launched the Epping Industrial Property Index, giving landlords and tenants an excellent overview of the market’s performance over time. With a breakdown of market trends at hand, our clients can make their own educated decisions. Plus, use our services for guidance going forward. This also helps to give customers a realistic view of what their properties or potential properties are worth. Deterring over-inflated prices that will never perform in the current environment.

With an insightful understanding of the industrial property market, years of experience, and professional advice, Epping Industrial Property has your best interests at heart.