The latest industrial property market statistics (2024_Q2) confirm some exciting trends for the industrial property market in Cape Town. Industrial Property Vacancy levels have significantly reduced in the last three years. Demand remains high for industrial space in Cape Town, albeit due to a slowing economy, load shedding, a weaker exchange rate, higher interest rates and political uncertainty.

Market rentals (rentals concluded at) have risen during the last 18 months due to lower supply and higher demand. Landlords are now actively trying to increase their rentals, reflected in the higher asking rentals during the last 18 months. In reality, the newer and more modern industrial buildings are getting closer to asking for rentals, and the older buildings are finding it harder to find tenants.

The average size of premises available for rent has increased, as a result of various smaller spaces being rented during the last quarter.

Epping Industrial Property Index

What do these statistics show us about the current Industrial Property Market?

- The amount of vacant industrial space in Cape Town is stabilising – at a low level.

- Asking rentals during the last 18 months has increased due to a lack of space supply. Landlords are now starting to dig their heels in for rental levels.

- Tenants are finding it harder and harder to find suitable premises to grow/ contract into.

- Landlords favour tenants prepared to sign longer leases with the shortage of industrial space to rent in Cape Town.

- Tenants are having to “up their game” in Cape Town. Landlords are requesting a history of rental payments, favourable references from previous Landlords, business plans and copies of up-to-date financials.

- Businesses are becoming aware of the efficiency of their premises. Issues such as height, stacking volume, number of columns in a warehouse, natural lighting, modern roofs, etc., are becoming factors in deciding upon premises.

- Businesses still favour the more modern industrial buildings, with most of these spaces now rented out, even at much higher rentals.

The industrial property sector is important in South Africa

The industrial property market in SA holds immense value. Utilised for many business types, uses range from versatile to efficient. At this point, it is difficult to say which industrial sectors, in particular, are slowing the most.

The “top-rated” buildings have the highest specifications. These buildings tend to let first. While these “top-rated” properties may have a higher R/m², they usually have much higher ceilings. They thus actually offer a lower R/m³ rate to tenants. Boasting full compliance with current fire regulations, lower electricity costs, advanced building materials and better business efficiencies, we give our clients access to prime industrial property. However, the overall amount of space for rent is still low. Companies must plan their moves well to ensure the suitable space is on time.

The only index for industrial property in Cape Town

These statistics back up what is happening within the industrial market.

This index is designed to assist property owners, tenants and other stakeholders in assessing the industrial real estate market, especially in Cape Town. Epping houses many of the most significant industrial companies in the Western Cape. It is an excellent gauge of industrial property in the entire Western Cape. The statistics forming the Epping Industrial Property Index are put together by the only company that works with landlords and tenants in Epping every day. Epping Property is the only company to have surveyed the existing industrial spaces, when completed, throughout the Epping area. Having measured the total square metres available for rent, our statistics are the most accurate.

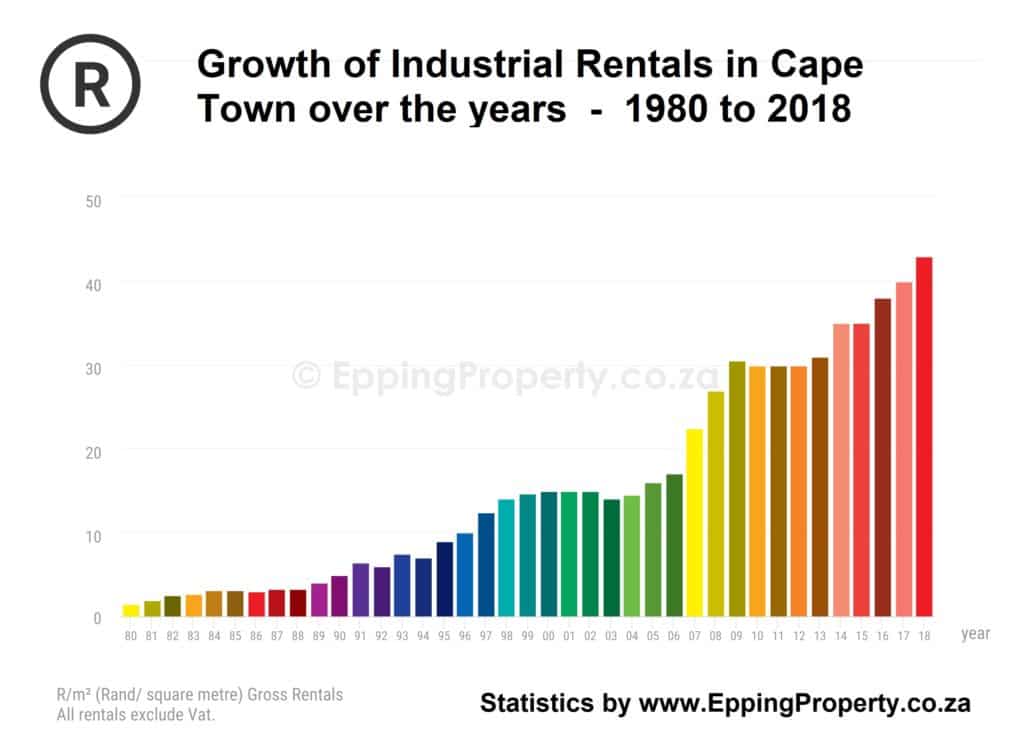

Historical Growth of Industrial Rentals in Epping Industria

Read about the long-term rental trends of Industrial Property in Cape Town

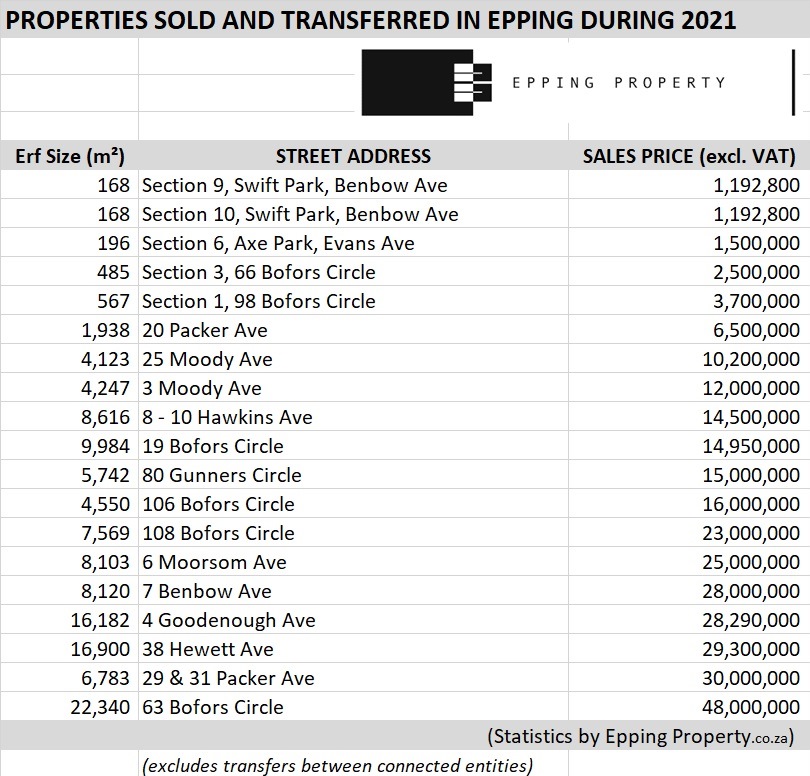

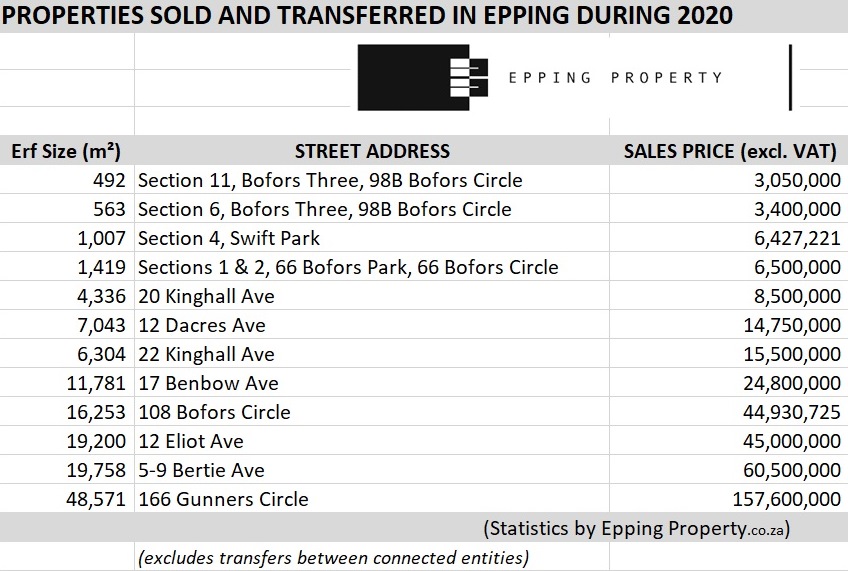

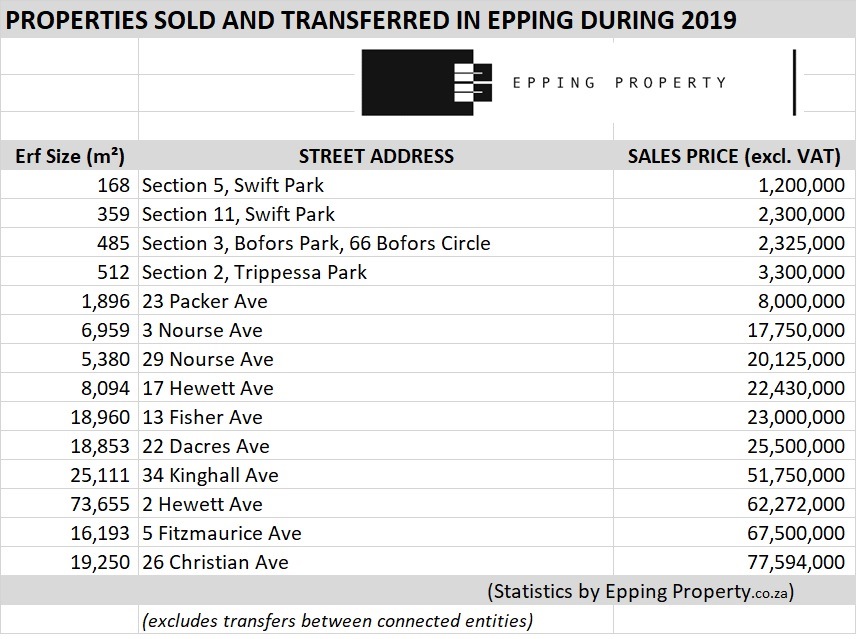

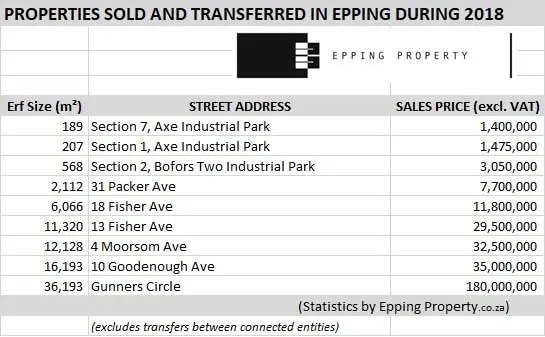

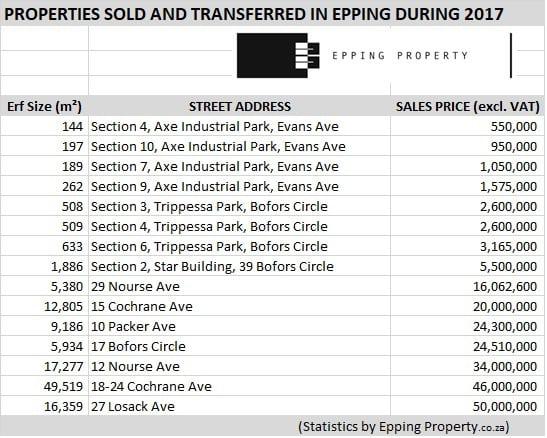

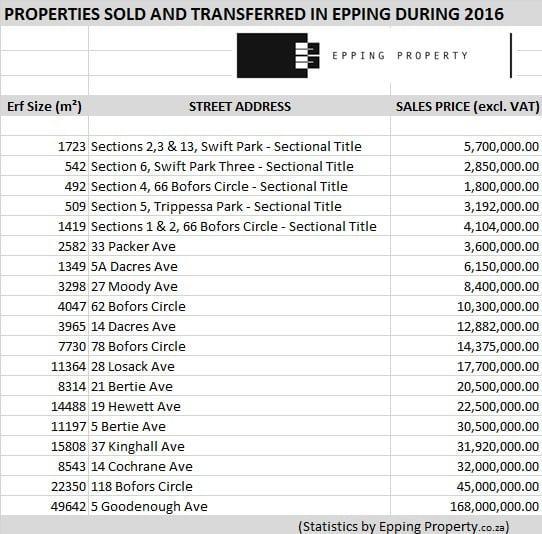

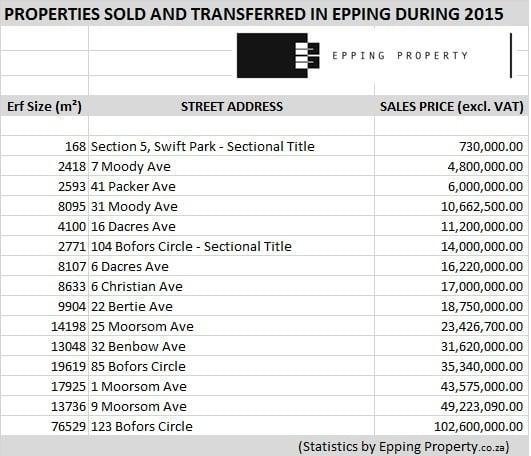

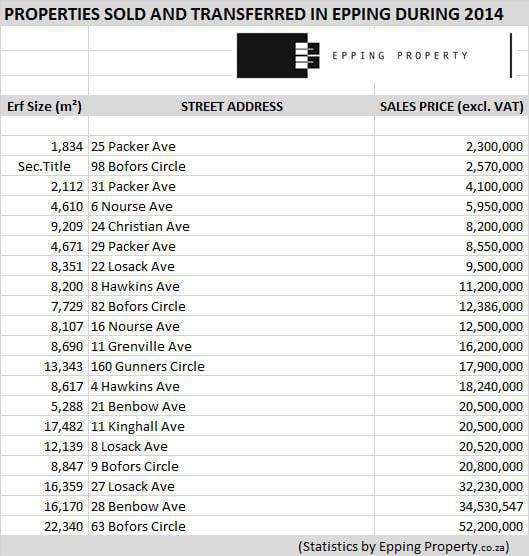

Sales of properties in Epping Industria

The above information is an excellent indicator of rental demand and supply. Hereunder are all the properties sold and transferred during 2021. (For interest purposes, we have recorded the transfers of 2014, 2015, 2016 and 2017, 2018, 2019, 2021, 2022 and 2023). Please bear in mind that properties have different building sizes: Erf size ratios and various other characteristics – it is only meaningful to compare similar properties. Please contact Epping Property for more details on property values in Epping and the Central industrial areas of Cape Town.