The Cape Town industrial property sector has been the best-performing property asset class in the last 12 months. Why is this, and will it continue?

Let us start by looking back on the main themes of industrial property in South Africa during the last year:

- The industrial property sector has been the best-performing property asset class in SA during the last year.

- Logistics and warehousing were the best-performing components of the industrial property sector.

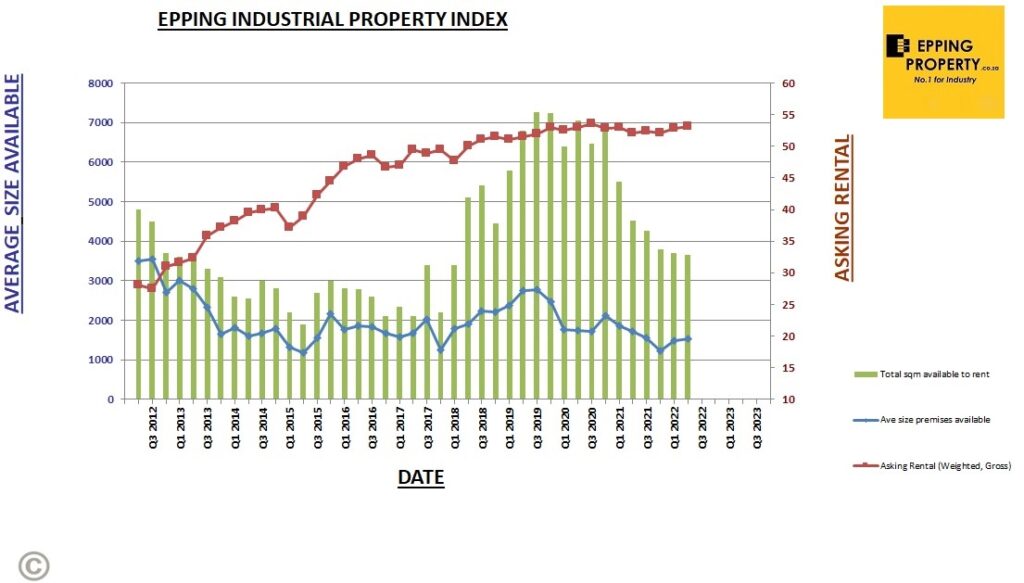

- There has been a stabilisation of industrial rentals. And, in some areas, growth in industrial rentals. As opposed to the lagging sectors of retail, office and leisure property.

- New industrial developments were minimal. These were mainly developed for specific businesses. An example of this is Truworths’ new industrial warehouse in King Air Industria,

- Efficient buildings/ warehouses were in more demand than older, less efficient buildings. Think m³ rather than m².

- Notwithstanding the difficult economic conditions, demand for environmentally friendly buildings was strong.

In Cape Town, the following additional factors have contributed to the success of the industrial property market:

- Cape Town is regarded as a great place to live, attracting many people “semigrating”. This is due to the success of the local government. As well as the beauty and good lifestyle in Cape Town.

- The successful upkeep of roads and infrastructure vs the rest of SA.

- The limited supply of developable industrial land.

- The attraction of large corporates consolidating their logistics warehouses. Most of these in one large modern facility.

- Demand continually outstripping supply. In addition, the film-making industry has chosen Cape Town as a hub to shoot new movies. Also, due to global supply chain uncertainties, importers of goods are resorting to over-stocking and hence increased usage of warehousing.

- The vacant industrial space for rent is at its lowest in 4 years. Epping Property alone has been involved in the leasing of more than 70,000m² in the last 3 months.

The Industrial Property Market in 2022 and beyond:

- The global economy is likely to remain weak into 2023. Higher international interest rates will hamper debt-laden and low-margin companies. Developing countries will likely react to interest rate movements by the larger developed countries into 2023.

- The Industrial Property sector in South Africa will remain challenging but better off than the retail, office and leisure sectors. The leisure sector may see a summer turnaround, depending on the number of international flights that will be permitted into SA.

- Companies utilising industrial property will continue to push for enhanced efficiencies.

- Modernisation across all business processes will be a continued theme. This includes further mechanisation of processes, where possible. Also, far greater utilisation of computerisation and cloud-based solutions. Along with better computerisation, access to buildings with fibre/ 5G will be critical.

- Along with greater computerisation, the ratio of offices to warehouse/ factory will continue to decrease (i.e., less office space).

- Demand for environmentally friendly buildings will increase.

- Hopefully, Eskom will not impose too much load shedding. However, as the economy picks up and the utilisation of power increases, Eskom’s ability to cope with the increased demand remains an ongoing concern.

- Certain businesses will try to keep leases short until a more significant amount of certainty returns. Landlords will demand higher rentals for the luxury of a shorter lease in the industrial property market.

- Industrial rentals will likely be the first property sector to show meaningful growth in the future.

With the positive outlook for the industrial property sector and the continued demand for Cape Town as a better place to live, industrial property in the Western Cape will likely continue to be the leader in terms of investment and tenant demand. Which in turn, says Epping Property, will lead to the growth in rentals and industrial property values.